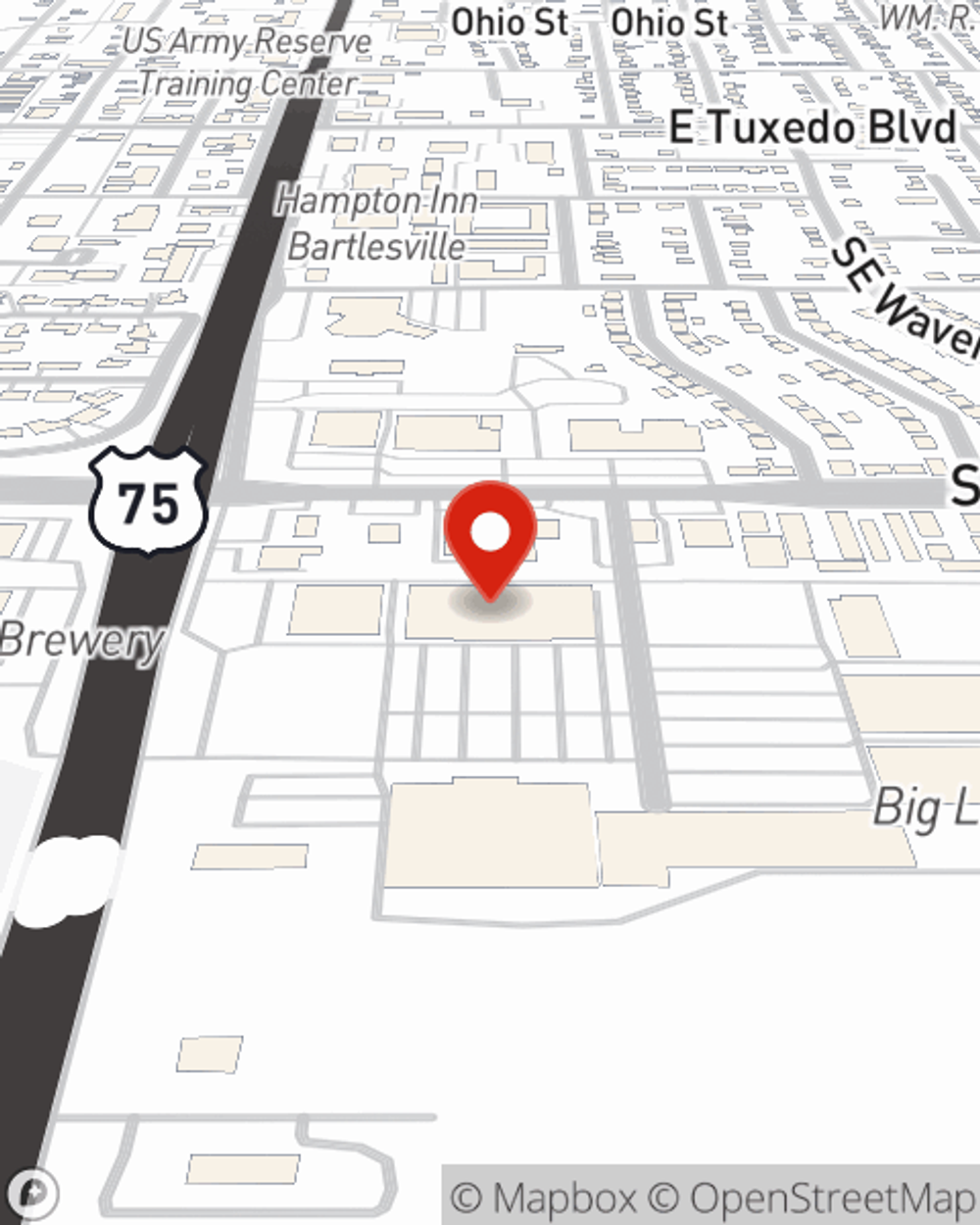

Business Insurance in and around Bartlesville

Bartlesville! Look no further for small business insurance.

Helping insure small businesses since 1935

- Dewey

- Ramona

- Ochelata

- Wann

- Nowata

- Osage County

- Washington County

- Nowata County

- Okesa

- Copan

- Delaware County

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of highs and lows. You shouldn't have to deal with those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including errors and omissions liability, worker's compensation for your employees and business continuity plans, among others.

Bartlesville! Look no further for small business insurance.

Helping insure small businesses since 1935

Customizable Coverage For Your Business

When you've put so much personal interest in a small business like yours, whether it's a sign painting company, a dance school, or a pet groomer, having the right insurance for you is important. As a business owner, as well, State Farm agent Jim Moore understands and is happy to offer exceptional service to fit the needs of you and your business.

Reach out agent Jim Moore to consider your small business coverage options today.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Jim Moore

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.